tax benefit rule examples

For example a tax credit for qualified. Significant tax savings can be obtained by understanding recognizing and applying the tax benefit rule.

What Is The Standard Deduction Tax Policy Center

One example of a situation covered by the tax benefit rule would be if a business listed an unpaid debt as an expense lowering its taxable income then recovered the money in a future tax year.

. Explain The Tax Benefit Rule With Examples 1. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit. Section 111 partially codifies the tax benefit rule which generally requires a taxpayer to include in gross income.

How Does a Tax Benefit Work. Amount of standard deduction - Head of household. 540 - tax refund from 1099-G 2.

This represents the total amount of state income tax withheld from your wages in 2012 from. Amount did not reduce the amount of tax imposed by Chapter 1 of the Code. For example if an employee who is required to be away from home overnight for rest is given meals the meals.

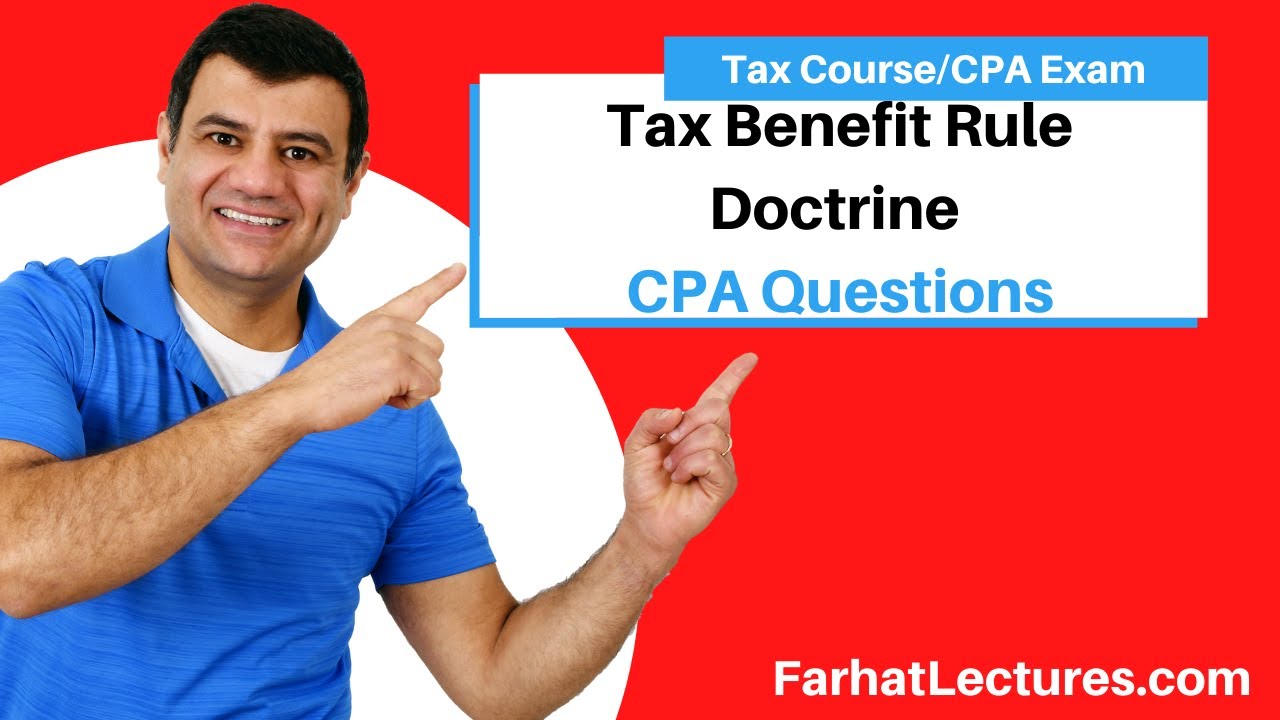

Tax benefits include tax credits tax deductions and tax deferrals. View Notes - tax benefit rule examples from TAXA 3300 at Baruch College CUNY. Recoveries of deductions claimed in previous tax years must be included in gross income in the year they are received.

The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation. Another example would be if somebody had to pay for repairs after an accident but later recovered the money in court from the person held responsible. The customer never paid so Company.

For example lets assume that in 2009 Company XYZ expected to receive 100000 from a customer. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross. In the above example the taxpayers AGI was reduced by 24323.

If a taxpayer takes a deduction in one year but recovers in a subsequent year some or all of the amount that gave. The tax benefit rule is straightforward at least on paper. Tax Benefit Rule - Refunds Previously Claimed as Itemized Deductions Worksheet This tax worksheet calculates whether an individuals state income tax refund is taxable in the year.

Jones recovers a 1000 loss that he had written off in his previous years tax. Acmes insurance company refuses to pay the claim. The building is a total loss.

Example of the Tax Benefit Rule Mr. The rule is promulgated by the Internal Revenue Service. Legal Definition of tax benefit rule.

Suffers a fire a few days after completion of a building that cost 500000 to build. For example - you deducted 1000 in state income taxes on your 2012 Schedule A. Total itemized deductions 3.

If a taxpayer for example claimed as a business expense. A tax benefit is a provision that allows taxpayers to pay less in taxes than what they would owe if that benefit were not in place.

Every Landlord S Tax Deduction Guide 9781413325683 Fishman J D Stephen Books Amazon Com

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Attention Business Owners Section 179 Tax Benefits Caskinette Ford

What Does It Mean To Be Pre Tax Or Tax Advantaged Finra Org

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Tax Benefit Rule Income Tax Course Cpa Exam Regulation Youtube

After Tax 401 K Contributions Retirement Benefits Fidelity

Investment Expenses What S Tax Deductible Charles Schwab

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Smart Philanthropy For 2022 Schwab Charitable Donor Advised Fund Schwab Charitable

Every Landlord S Tax Deduction Guide Fishman J D Stephen

Tax Benefit Rule Doctrine Explained With Exam Cpa Exam Regulation Income Tax Course Schedule A Youtube

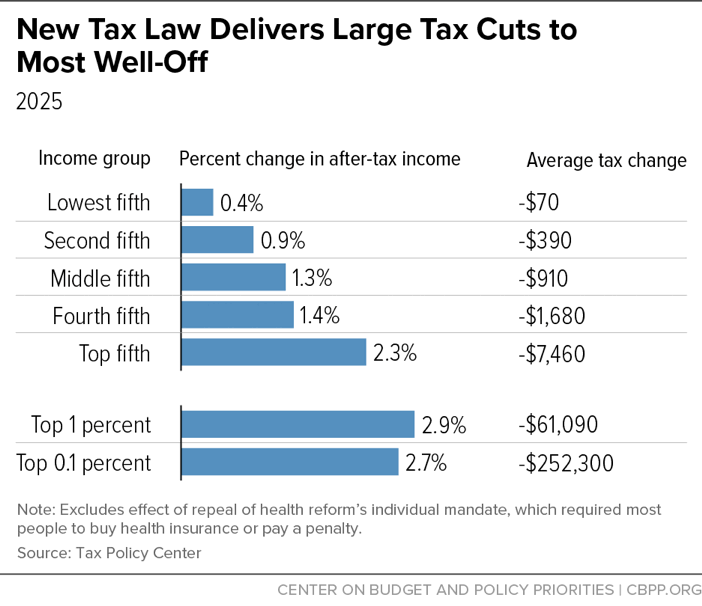

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

Accelerating Tax Deductions For Prepaid Expenses Windes

What Is The Tax Benefit Rule Thestreet

How Does The Deduction For State And Local Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)